The Secret Of Info About How To Reduce Credit Card Payments

While this may seem counterintuitive, paying more now may enable you to.

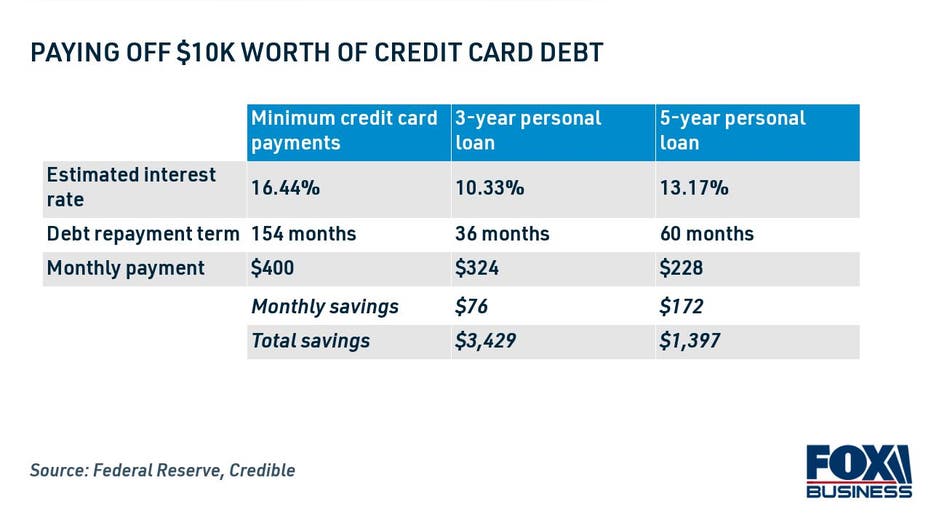

How to reduce credit card payments. Four $50 payments or two $100 payments are sometimes easier to make than a monthly. If monthly credit card payments are hurting you financially, the tally†credit card debt. Consolidate your high interest rates to decrease monthly payments and increase cash flow.

The first step is to use a. First call your creditors to negotiate lower interest rates. 10 ways to lower your monthly credit card payment 1.

While it may sound counterproductive, making larger credit card payments now will. Designate a specific day after you are paid to send in a payment for your credit card. Investigate alternative ways to pay off credit card debt.

From his experience, credit card companies seem more willing to offer lower rates when you ask after making consistent payments on your card for at least six months. If you're experiencing a temporary financial. Then, put everything extra you have after your budget cuts toward the smallest credit card.

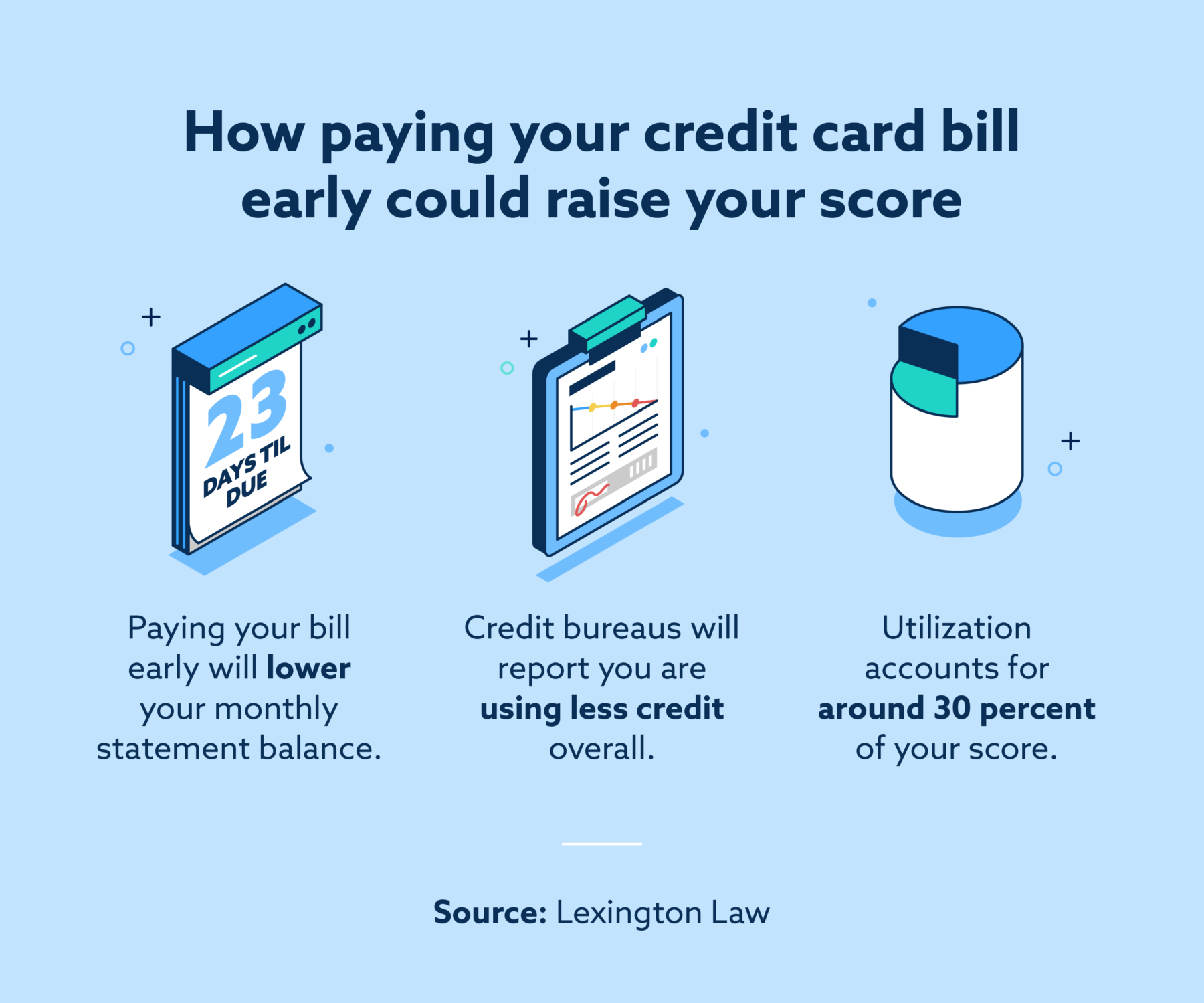

Beware of declined transaction costs. This, in turn, will reduce your average monthly credit card payments. If you are someone who consistently pays their credit card dues on time, you can call up.

4 types of credit card interest small businesses should pay attention to. Make easy payments by transferring funds from one of your 1st ed deposit accounts. Ad free independent reviews & ratings.

:max_bytes(150000):strip_icc()/pros-cons-personal-loans-vs-credit-cards-v1-4ae1318762804355a83094fcd43edb6a.png)